We’re buzzing!

Published March 8, 2022

“Honeybee CEO and co-founder Ennie Lim shares her experiences launching the financial wellness fintech in the wake of her own personal financial challenges. In this episode of EMERGE Everywhere, Ennie joins Jennifer to talk about coping with gender discrimination in financial services, helping employers navigate operational transformation through the height of the pandemic, and uncovering effective solutions for vulnerable workers, like rainy day funds for workplaces. Listen to learn how Ennie and HoneyBee are bridging financial literacy gaps, and taking steps toward workplace equality.”

ENNIE LIM USED HER LIFELONG FINANCIAL CHALLENGES TO BUILD HONEYBEE, A PLATFORM THAT HELPS EMPLOYEES REACH FINANCIAL SECURITY

Published October, 2021

“Today, Lim is the co-founder and CEO of financial solutions platform HoneyBee, which offers 0% APR loans of up to a thousand dollars to employees in need, as well as personalized financial coaching. But her path to the C-suite was hard-won.”

HONEYBEE RAISES MILLIONS TO MAKE FINANCIAL WELLNESS A WORKPLACE BENEFIT

Published September 7, 2021

“The Los Angeles-based Certified B Corp describes itself as a B2B financial technology company that is on a mission to give employees — and their families — free access to financial support in the workplace as a benefit. That support could come in the form of employer-sponsored “no-cost rainy day funds” and on-demand financial therapy with the goal of “creating a healthier workforce environment.”

Published July 26, 2021

“At age nine, Lim and her family immigrated to Montreal, Canada, from Malaysia. When an unexpected medical condition left Lim’s father unable to work, her mother was forced to assume the role of sole breadwinner for a family of four. Lim watched her struggle to make ends meet, living paycheck to paycheck and relying on last-minute loans from employers when money got tight.”

FINANCIAL WELLNESS IS A CRITICAL TOOL FOR DEI INITIATIVES

Published April 08, 2021

“In order to make benefits equitable and inclusive you have to make sure that you’re actually thinking about different methods to achieve that,” says Ennie Lim, CEO and co-founder of HoneyBee, a financial wellness benefit platform. “We help employers prioritize financial equity, inclusion and well-being in the workplace by reducing the financial literacy gap.”

CREATING A CORPORATE CULTURE THAT PROMOTES FINANCIAL HEALTH

Published February 19, 2021

Financial pressures have increased dramatically over the last year. Between the delays in government assistance and added expenses due to the pandemic, your employees’ and co-workers’ financial burdens have grown.

THIS ENTREPRENEUR BUILT HER BUSINESS AROUND HELPING OTHERS FOCUS ON FINANCIAL WELLNESS

Published September 24, 2020

The founder of Honeybee, Ennie Lim suffered a major financial setback. Now she’s helping others endure their own.

DO BUSINESSES HAVE A ROLE IN SOLVING POVERTY IN THE TIME OF COVID-19? THESE B CORPS SAY “YES”.

Published September 22, 2020

COVID-19 shook what was a fragile financial foundation for many people in the United States: 78% of Americans live paycheck to paycheck, and 69% have less than $1,000 in savings for an emergency. That means small and large unexpected events, from car trouble to medical bills to job loss, can lead to a financial spiral or force workers to borrow against their retirement fund. In short, the effects of the coronavirus have been felt most by the least fortunate among us.

YOUR EMPLOYEES NEED ACTIONABLE FINANCIAL EDUCATION NOW MORE THAN EVER

Published September 18, 2020

According to recent data analyzed by Fortune, 83% of Americans are worried about their long-term finances, and 80% are worried about their short-term financial situation. And, according to a recent study by MetLife, employees with good financial health are twice as likely to report having good mental health than those with poor financial health.

HOW TO MOVE BEYOND DISCUSSIONS ABOUT DIVERSITY AND INCLUSION

Published July 8, 2020

Enhance your diversity and inclusion initiatives by acknowledging systemic barriers to financial health and providing solutions. Look for programs that don’t rely on creditworthiness to loan funds, and that deliver personalized, actionable financial education.

EMPLOYEES NEED ACCESS TO AFFORDABLE CREDIT NOW MORE THAN EVER

Published May 22, 2020

The coronavirus pandemic has made credit scores much less reliable in determining the trustworthiness of borrowers and their associated risk. Virtually overnight, financial institutions must completely reassess the perceived risk of lending to consumers. It’s uncharted territory.

FINANCIAL WELLNESS PROGRAMS SHOW YOUR EMPLOYEES YOU HAVE THEIR BACK

Published April 13, 2020

Though employers may feel they’re doing enough in terms of implementing safety precautions, and in some cases, are increasing wages, their employees need more. Workers need to know unequivocally that their employers have their back.

HOW COMPANIES CAN FINANCIALLY SUPPORT WORKERS WHO CAN’T GO REMOTE

Published March 17, 2020

COVID-19 has brought flex time and remote work into the spotlight and forced us to re-evaluate our work culture. We’re putting our long-held values and beliefs about being physically present in the office on pause.

10 INNOVATIVE WOMEN BUILDING MEGA-SUCCESSFUL BUSINESSES THAT ARE SHAKING UP THEIR INDUSTRIES

Published September 16, 2020

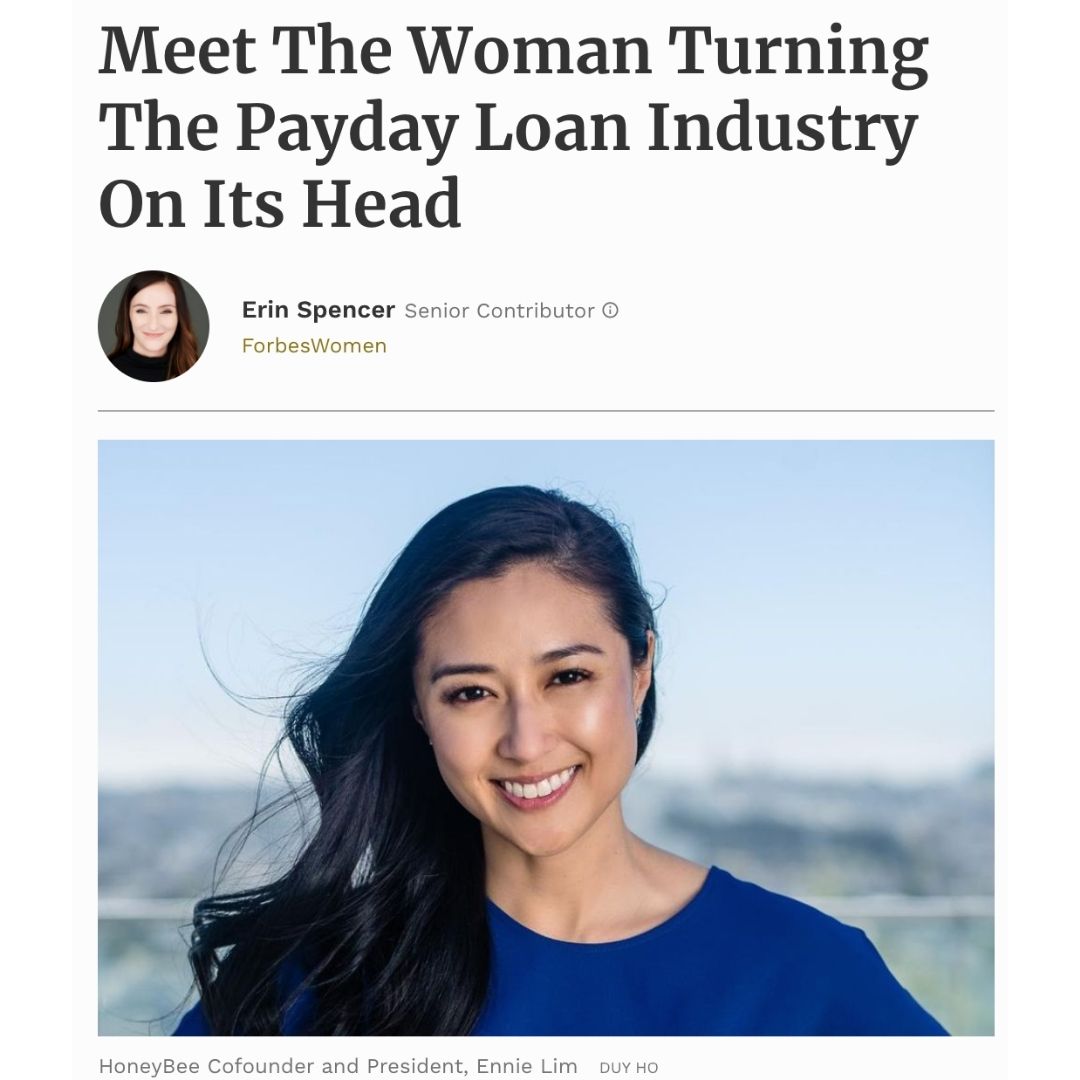

Lim knows how important, and precarious, one’s credit score can be. After her divorce, the so-called age on her score suddenly sank to zero–and older is generally better. Her only option for a personal loan: payday lenders. “Payday loans take advantage of some of the most vulnerable people in America,” says Lim of the $90 billion industry.

THE 100 WOMEN BUILDING AMERICA’S MOST INNOVATIVE AND AMBITIOUS BUSINESSES

Published September 16, 2019

The entrepreneurs on Inc.’s second annual Female Founders 100 list have transformed every major industry in America. Meet the boundless dreamers making the biggest difference in 2019.

DON’T IGNORE YOUR EMPLOYEES’ FINANCIAL STRUGGLES

Published January 18, 2019

41% of American adults could not cover a $400 emergency with cash, savings, or a credit card they could pay off entirely when the statement came in. So, if the car breaks down, the lease is up, and they need to pay a security deposit; a long-distance relative is sick and they need to get on a plane; or they break a tooth and don’t carry dental insurance, they are stuck. And stressed. One financial crisis can completely disrupt their lives.

MEET THE WOMAN TURNING THE PAYDAY LOAN INDUSTRY ON ITS HEAD

Published January 11, 2019

It’s the early 2000s and Ennie Lim is what creditors refer to as credit invisible. Despite touting a bachelors degree from a prestigious university in Montreal and logging several years of work experience in the US working for San Fransisco nonprofits, Lim has no history with any of the US banking institutions and therefore is unable to get approved for any of the major credit cards.

Published July 19, 2018

This crisis has rippling effects across the workplace and the economy as a whole, but for several reasons, it is rarely discussed. Financial wellness is a big part of the mental and emotional health of working adults. Admitting one’s struggle is a vulnerable act fraught with potential risks, both social and financial.