Win the race for talent

HoneyBee empowers HR leaders to attract new talent and improve retention with a best-in-class supplemental financial wellness program that meets the financial needs of the modern-day workforce.

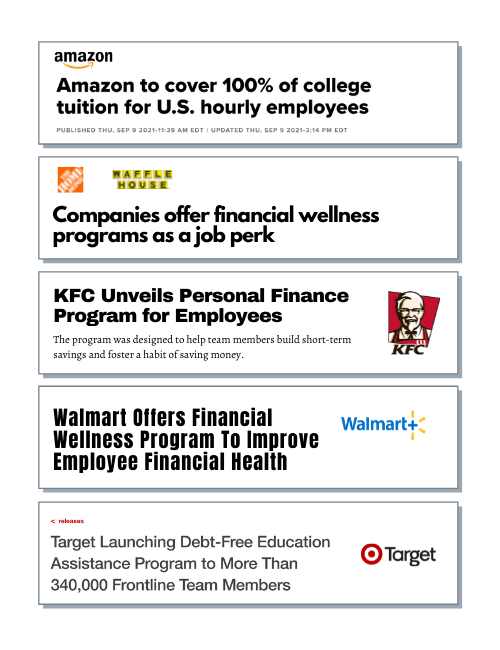

Corporations are spending millions supercharging their 401(k) plan with supplemental financial wellness programs

‣ A 401(k) is no longer a competitive differentiator

‣ 3 out of 4 young workers wished their workplace provided more resources to help with their overall financial well-being

‣ 4 out of 5 employees have used the financial wellness programs their employers provide

Comprehensive financial wellness program that meets the financial needs of the modern day workforce

Honey Funds

Funds to help pay off debt & manage expenses

All employees regardless of their credit, can access no-cost, 0% funds on-demand to help pay off debt and manage expenses.

Honey Academy

Financial education for employees & families

Our live and recorded webinar series help your employees and their children learn in an inspiring way so they can get a head start.

Honey Therapy

1-on-1 sessions for all money matters

Confidential sessions with money therapists for employees to set customized plans to achieve their financial goals.

“Each year when we survey our employees HoneyBee is consistently one of the top 3 ancillary benefits we provide”

HR Director, Alameda County Community Food Bank

Proud to be working with leading employers

Employees ♥ HoneyBee

Yolanda

HEALTHCARE WORKER

“From Fortune 500 to small businesses, this program should be in every company!”

Stephanie

Hospitality Manager

“As a single mother, financial burden held heavy on my mind. Glad I had HoneyBee!”

Tracina

Non-Profit Employee

“HoneyBee helped me improve my credit and gave an extreme peace of mind.”

Learn how HoneyBee empowers HR leaders to attract new talent and improve retention with a best-in-class supplemental financial wellness program that meets the financial needs of the modern-day workforce.

info@meethoneybee.com

1.800.683.8663

(M-F: 7am to 5:30pm PT)