Did you know credit card companies want you to make only minimum payments on your credit card bills so they can keep profiting off of you for a long loooonng time?

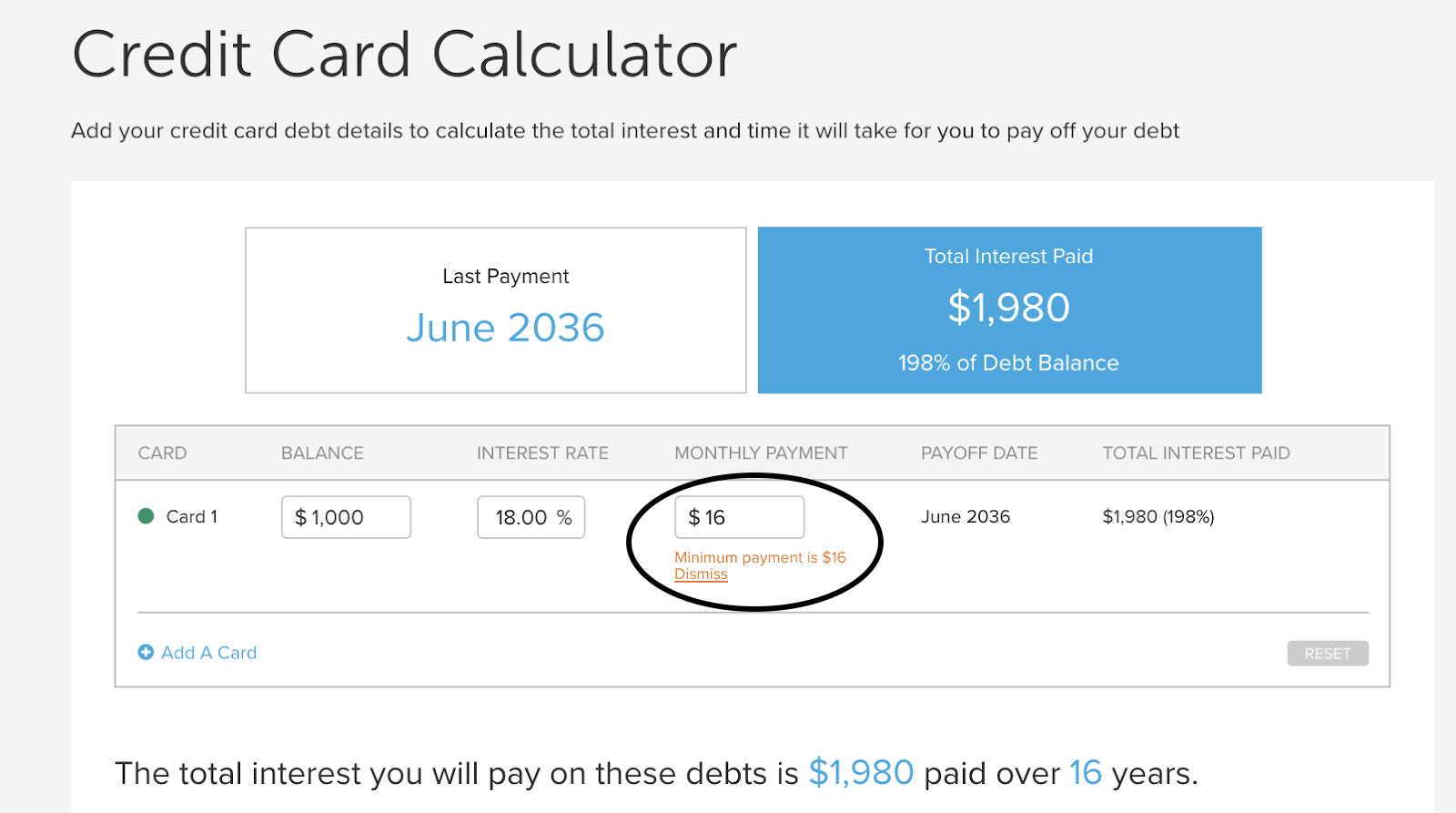

For example, if you have $1,000 worth of credit card debt right now and don’t make any new purchases, it will take you 16 years to pay it off. 16 YEARS!!!

And you’ll pay almost $2,000 in interest!

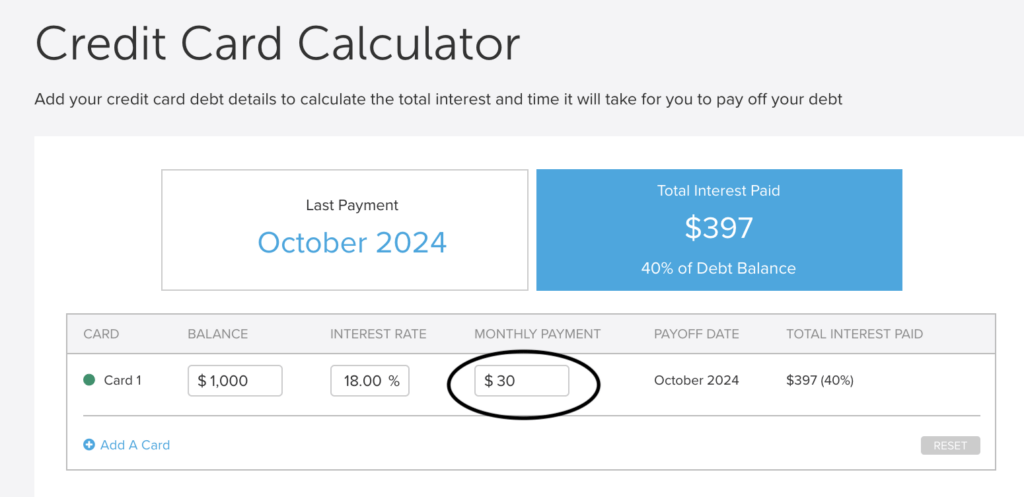

You can significantly cut down on the time it will take you to repay your debt by paying more than the minimum payment each month.

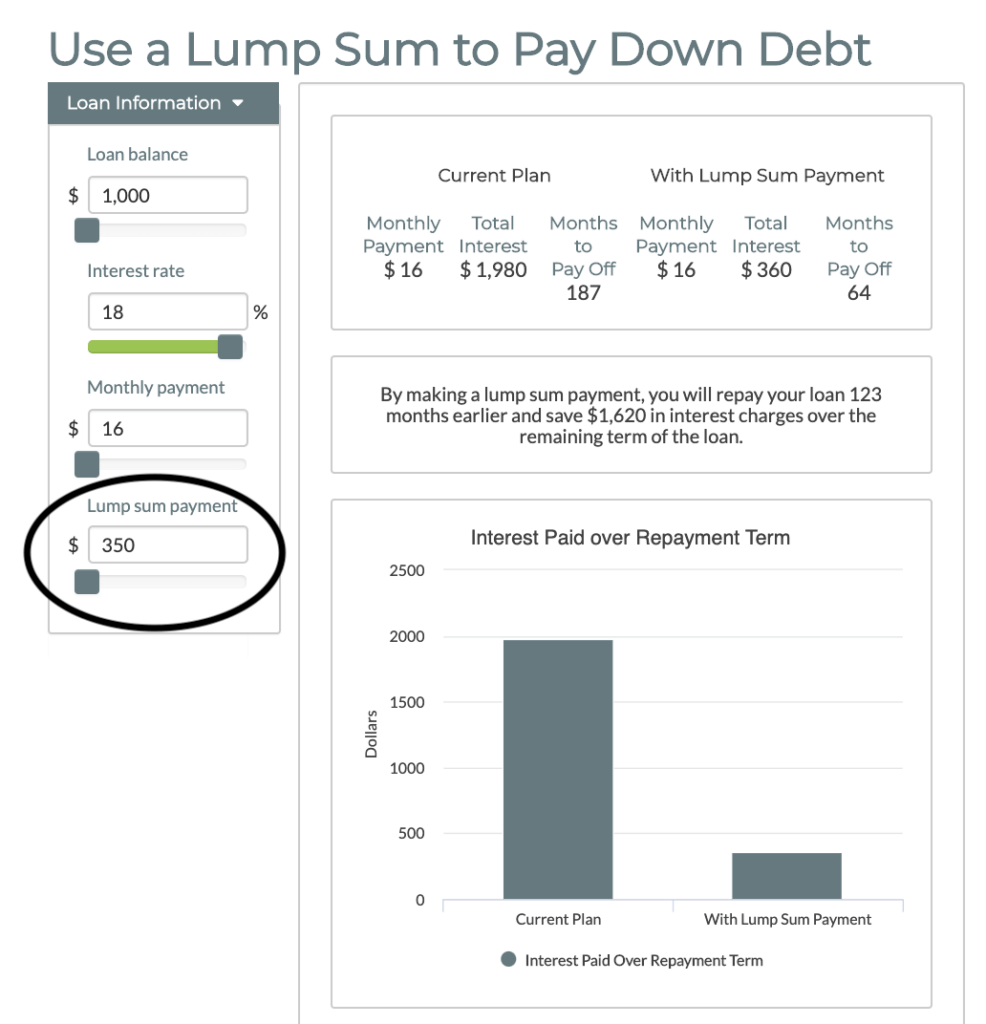

Or by using a lump-sum strategy to reduce your debt every few months (see image below).

But these strategies only work if you have extra cash.

So, where can you get the extra cash you need to start paying down your credit card bill?

HoneyBee!

HoneyBee is a financial wellness benefit for employees of participating employers. We provide 0% APR loans, financial education, and confidential financial coaching. 0% APR means we don’t charge any interest or fees. If you borrow $300 from HoneyBee, you’ll pay back $300. Seriously.

It might sound kind of crazy to borrow money from HoneyBee to pay down your debt. But that’s exactly why we exist! We want to stop you from paying too much in interest and fees, so you can start feeling financially secure.

We follow the CFPB’s safe loan guidelines, which means we only loan out small amounts of money and give you 2 months to pay us back. If you ever have problems making a payment, give us a call.

You can also chat with a Bee Financial Coach to optimize your debt repayment strategy.

HoneyBee is an employer-sponsored financial wellness employee benefit. If your organization has partnered with us, you can access our programs at no cost to you. If you’d like to refer your employer, give us a call at 1.800.683.8663 (M-F: 8:30am to 5:30pm PT) or send us an email at info@meethoneybee.com.