Experts agree you should have 3 to 6 months of your salary in savings. Here’s why that’s hard for your employees.

Traditional savings advice stops people from taking action

In their 2019 report, economists Emily Gallagher and Jorge Sabat challenge traditional savings rules. They found that while the traditional advice to save 3–6 months salary wasn’t bad, it didn’t feel attainable for lower-income people.

They were intrigued by the idea that a smaller, more attainable number might motivate people to save. They wanted to prove that a smaller number, a “minimum amount” could still be beneficial.

And they did. The minimum number they came up with for low-income people to work towards is $2,467 in savings. They told CNBC, “If you have that much saved, your probability of falling into financial hardship (not being able to pay rent, bills or medical care) is low.”

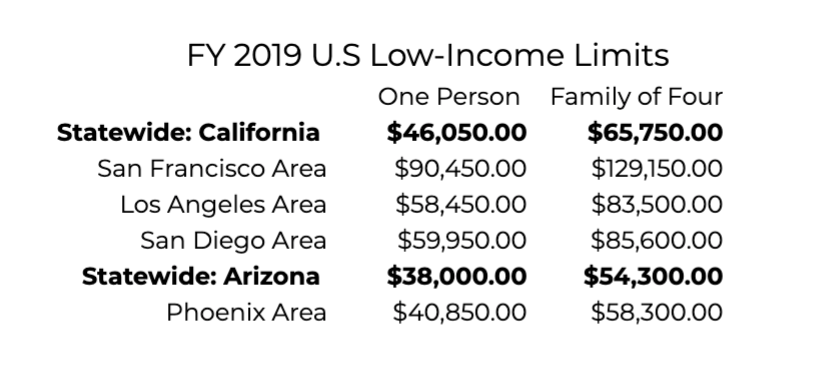

So, what does it mean to be low-income? In general, to qualify as low-income, a person or family makes around 80 percent of the area’s median income level. The Low-Income Limits, as defined by the U.S Department of Housing and Urban Development, are different depending on the area in which someone lives. The table below can give you an idea of who this advice is geared towards.

However, the rest of America is not off the hook. Though the advice is geared toward low-income people, Americans as a whole could benefit from it. According to a survey by Bankrate, 21% of working Americans aren’t saving anything at all. And, according to GOBankingRates’ most recent savings survey, 58% of Americans have less than $1,000 in savings. Any amount of money saved should be counted as a win. And it seems like more of us should have a specific goal in mind when it comes to savings.

Help your employees achieve $2,467 in savings

So, if Americans at every income level have trouble saving, how can we break the cycle?

Start with a realistic savings goal, like $2,467. Next help your employees gain momentum by offering financial wellness benefits that support their savings goals.

Provide access to interest-free funds

Access to interest-free funds can help your employees feel financially secure. This alleviates the psychological burden of not having enough to cover emergency expenses before they actually have an emergency savings account.

Shifting their mindset from “I’m one emergency expense away from a disaster” to one of “I can do this” is huge. Fear can stop people in their tracks. Help your employees move past their fears by offering a financial and psychological safety net.

Provide access to trusted financial counselors or financial literacy workshops

According to a 2018 report by the TIAA Institute, most Americans lack the knowledge necessary to make routine financial decisions. In addition, they found that individuals with greater financial knowledge are more likely to experience positive financial outcomes. In other words, financial literacy matters. The more educated your employees are about their financial lives, the better their finances will become. Help educate and inspire your employees to take action.

Motivate your employees to reach financial goals by pairing them up with expert one-on-one financial counselors. Personal finance is confusing. Having a trusted advisor to turn to could be the difference between fear-based financial decisions and knowledge-based ones for your employees. Or, provide financial wellness workshops that cover things like creating an emergency fund, saving for a house or car, saving for retirement, and saving for dreams.

Start talking to your employees about their financial well-being today. Every bit of financial support makes a difference.